Sentiment Strategy: Beginner's Guide [EN]

You have downloaded the FXSSI Pro Indicators package. Thank you for your interest. But what's next? Read a detailed Sentiment Strategy guide below for a better understanding.

![Sentiment Strategy: Beginner's Guide [EN]](https://fxssi.com.tr/images/wp/wp-content/uploads/2021/10/image-64x64.jpg)

![Sentiment Strategy: Beginner's Guide [EN]](https://fxssi.com.tr/images/wp/wp-content/uploads/2020/04/poster-beginners-guide.jpg)

Let’s See if Everything is Ready for Work

Run any indicator from the package.

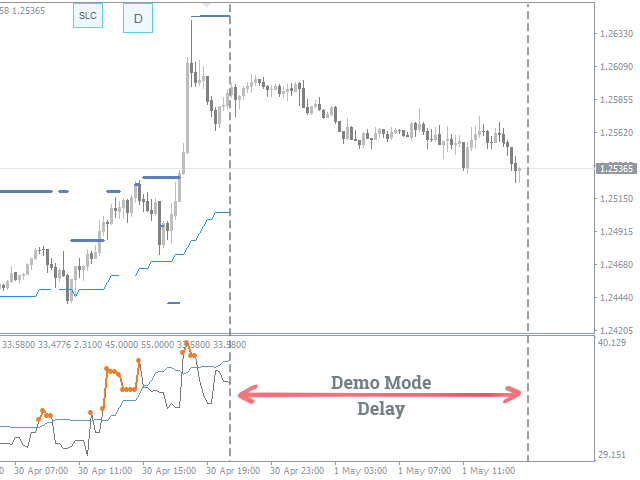

The indicators are ready for work if their status bar is shown as a green or blue circle with a green border. The blue circle indicates a demo mode in this case.

Otherwise, study the instruction in more detail. You may have missed something during the installation. Click the link to read the instruction.

Demo Mode

Demo mode allows you to check out the indicators from the FXSSI Pro pack before you activate your subscription. It differs from the full one only in that it doesn’t display data for the current day.

In addition, demo mode allows you to analyse previous trading situations over the past few months to prove the efficiency of our indicators.

Contents of the Guide

- Strategy Basics.

- Signals of indicators.

- Multipurpose usage of indicators.

- Conclusion.

- Risk warning.

- Contact details.

Contrarian Strategy Basics

The well-known Pareto principle stating that “80% of the entire wealth is owned by 20% of the world’s population” underlies the trading technique based on the market sentiment.

Applying this principle to Forex and other financial instruments, we can assume that the market is moving against the majority, namely small traders, to the benefit of large banks, funds, brokers, and other financial institutions.

This guide covers the basic techniques for analysing the market situation from the perspective of the contrarian strategy, as well as the recommendations for trading using the FXSSI indicators:

- How to determine trade entry and exit points.

- Setting Stop Loss.

- Setting Take Profit.

- Placing Limit orders.

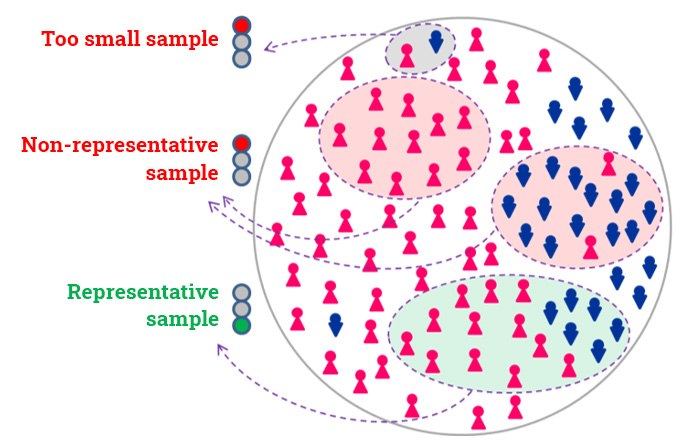

Data on open positions and pending orders of the largest brokers are used to analyze the behavior of most small traders.

Comparing this data with the results of exit polls that mostly show close to actual values, we can say that the market sentiment of 1% of traders will be the same as that of the rest 99% of traders.

In mathematical statistics, this approach is called representative sampling. It is also successfully applied in the forming of focus groups for marketing and advertising campaigns.

Book of Positions and Pending Orders is the basis of the Entire Strategy

When analyzing the market sentiment, first of all, we need to understand:

- at what price levels Buy and Sell trades of retail traders are opened;

- where Stop Losses and Take Profits of these trades are positioned;

- where pending orders are placed.

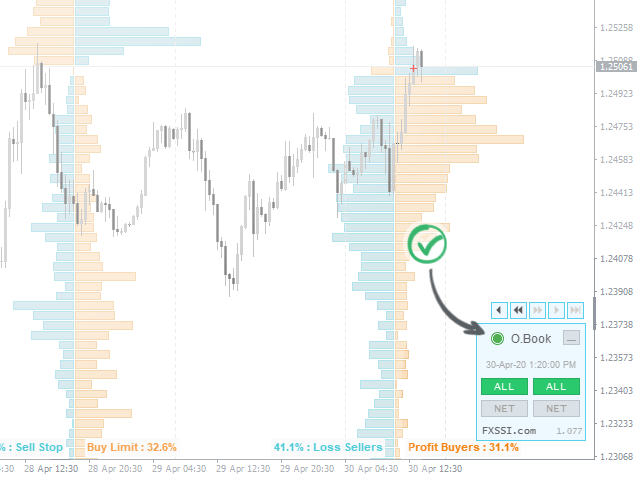

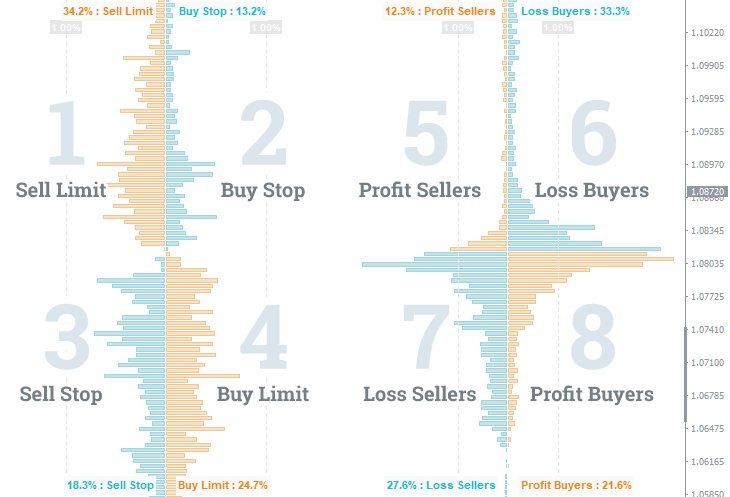

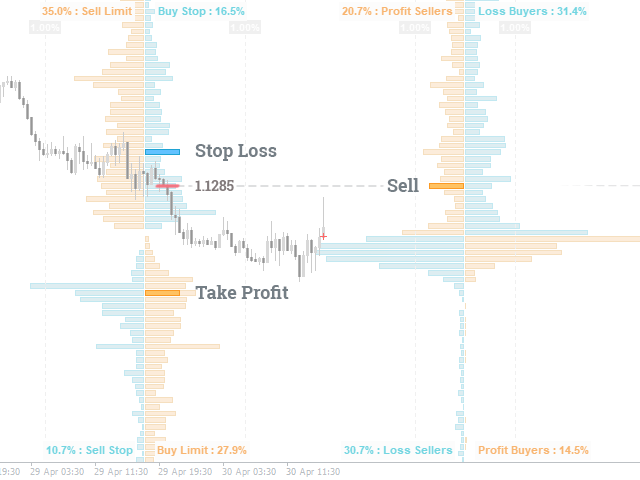

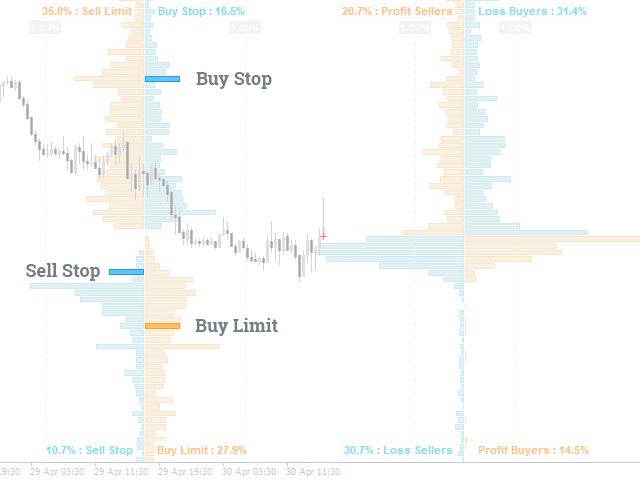

The combination of these trades is called the Order Book.

The Order Book is a graphic representation of trading activity, namely open trades, pending orders, and Stop orders.

At each price level, data on trades are summed up and presented as a histogram. As a result, we get a picture like this:

When a trader opens a trade, it is displayed on the right side of the order book as a horizontal bar. Its width depends on the volume of this trade.

When a trader places Take Profit, Stop Loss, or other pending order, they are shown on the left side of the order book as horizontal bars at the respective price level.

Due to human psychology, trades are distributed unevenly. When analysing the order book, you can discover large clusters of positions and pending orders at different price levels. Such abnormal clusters both on the left and one the right sides of the order book are of interest to us.

Even though the Order Book is the most informative tool, a trader, who studies the “trading against the crowd” strategy, might find it rather difficult to understand at first. So our team has developed the package of seven FXSSI indicators that provide key data obtained from the Order Book. The supplied information is ready for analysis and is displayed clearly and in a straightforward manner.

This guide covers the FXSSI Indicators package revealing the essence and principles of trading with them. In case you’re interested in the detailed analysis of the Order Book, we have a separate Guide for you.

Features and General Recommendations

There are sometimes situations when the market moves to the benefit of the market majority, which is quite a natural phenomenon. Otherwise, the price would never reverse.

According to our research, the average success rate of signals received from the FXSSI indicators ranges within 60-70%. It is a high percentage – not many strategies show such a result in practice.

However, one shouldn’t forget about money management. Any trading system has losing trades, and ours is no exception. Following the money management rules will allow you to minimise the negative effect of losing trades.

The signals of FXSSI indicators are easily combined and can be used in a comprehensive analysis, which also increases the chances of making a winning trade. We’ll show you a few examples of how to do it at the end of this guide.

Use our technique as an additional filter to your current trading strategy, since it has been repeatedly noted that combining alternative trading systems with the given one creates a highly synergistic (combined) effect in trading.

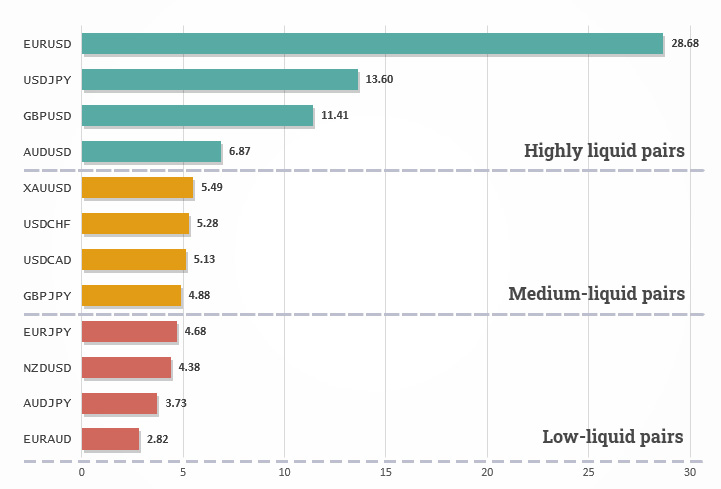

Data on open trades and orders are available for the following currency pairs:

We recommend starting with the most liquid currency pairs from the first group since their readings are less influenced by retail traders.

Readings of the indicators update every 20 minutes, which gives an opportunity to make decisions even in short-term (intraday) trading.

Next, we present the basic signals of the FXSSI indicators to enter and exit trades, as well as recommendations for a quick start in trading based on the “against the crowd” strategy.

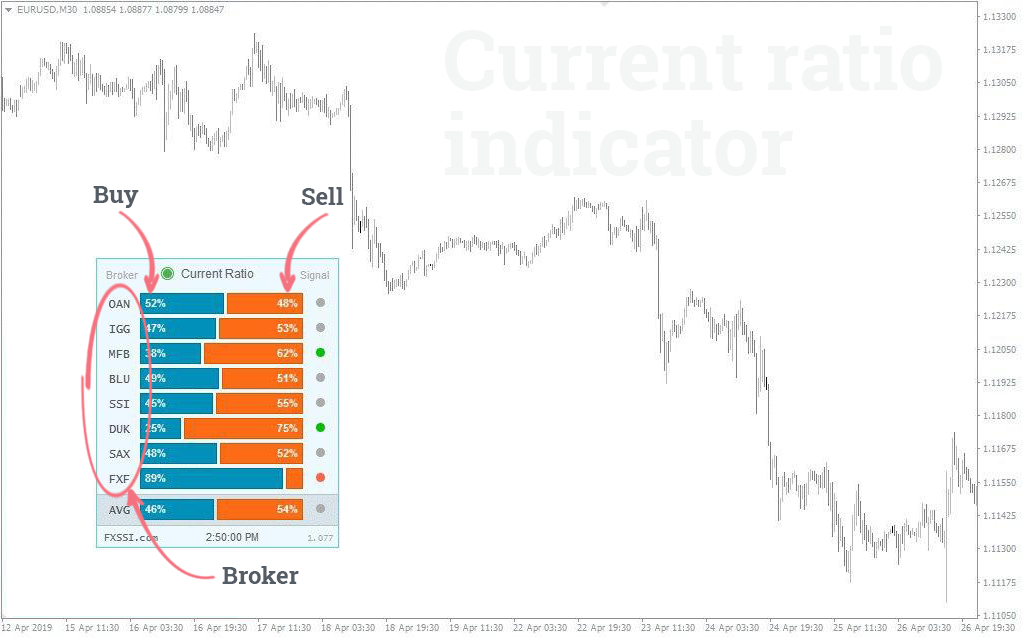

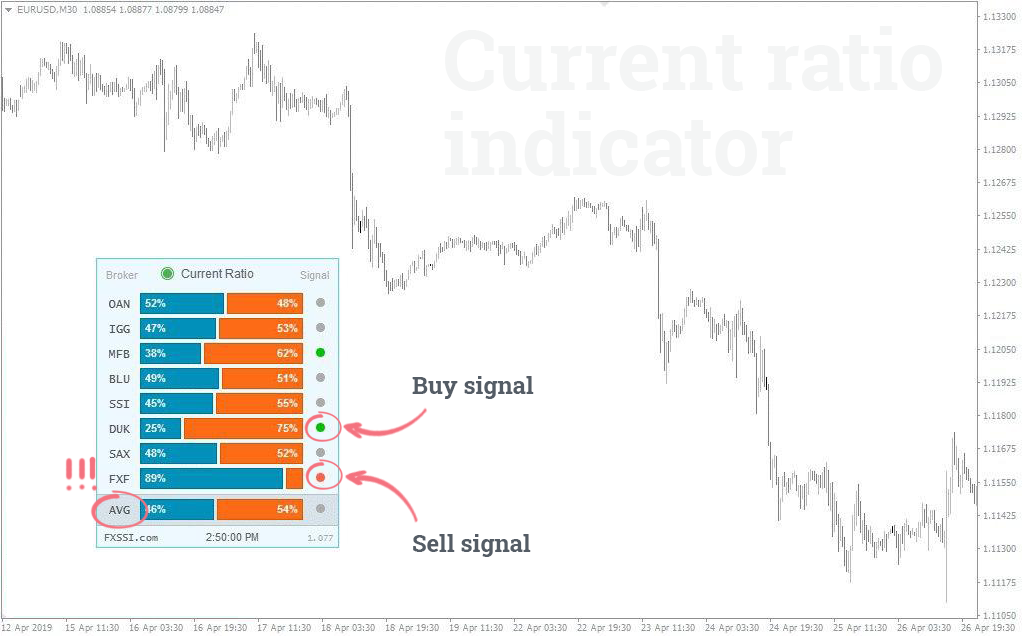

Current Ratio Indicator

The indicator shows: the percentage ratio of traders who are holding long and short positions. These data come from a few brokers disclosing the information about open positions of traders.

Purpose: identifying trade entry and exit points according to the current readings of the indicator.

Pay attention to: the Current Ratio indicator average value (AVG) calculated based on the weight coefficients of several brokers.

Buy: when less than 40% of traders are holding long positions (green circle).

Sell: when more than 60% of traders are holding long positions (red circle).

Trade exit:

- balance of ~50/50% has been reached;

- the ratio of positions has gone beyond 30% or 70%, which indicates that the financial instrument is significantly overbought or oversold.

The indicator doesn’t show particular levels for setting Take Profits and Stop Losses, but the following parameters are the most efficient:

Take Profit: 40-80 points, depending on the market situation.

Stop Loss: 40-80 points, depending on the market situation.

Indicator Features:

- Following a trend.

- Mid-term trading.

- The timeframe does not matter.

Advantage: it signals to buy or to sell using an indicative circle of the corresponding color.

The success rate of signal (in percent): from 55 to 70%.

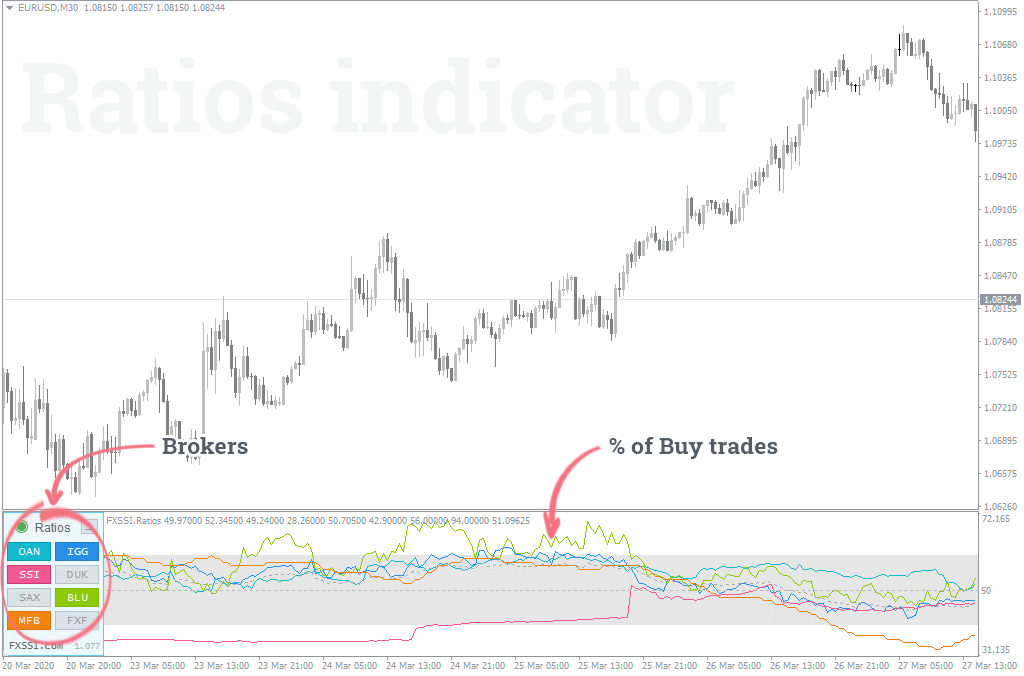

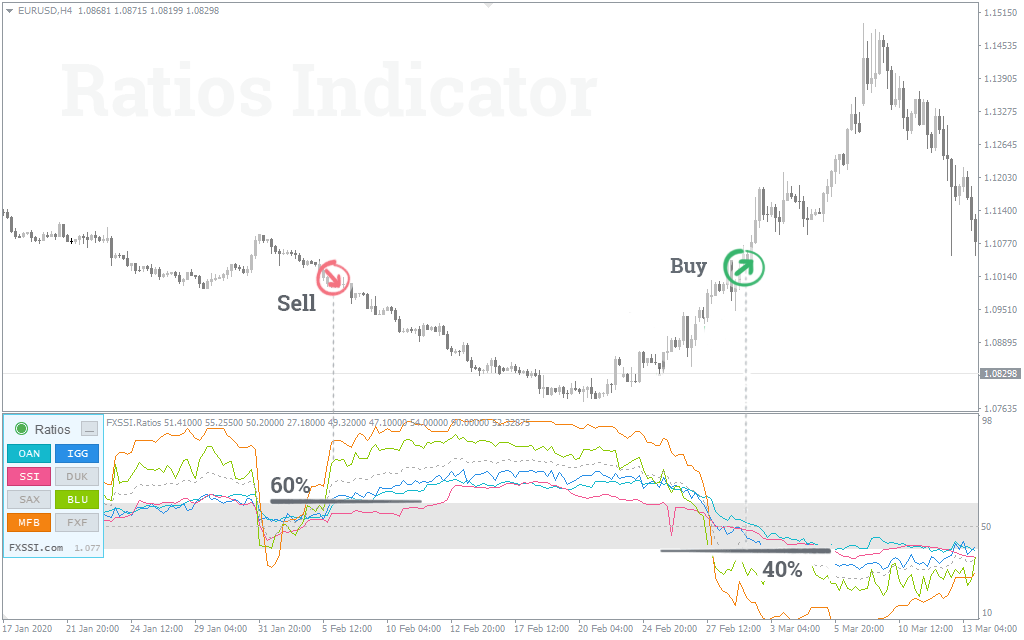

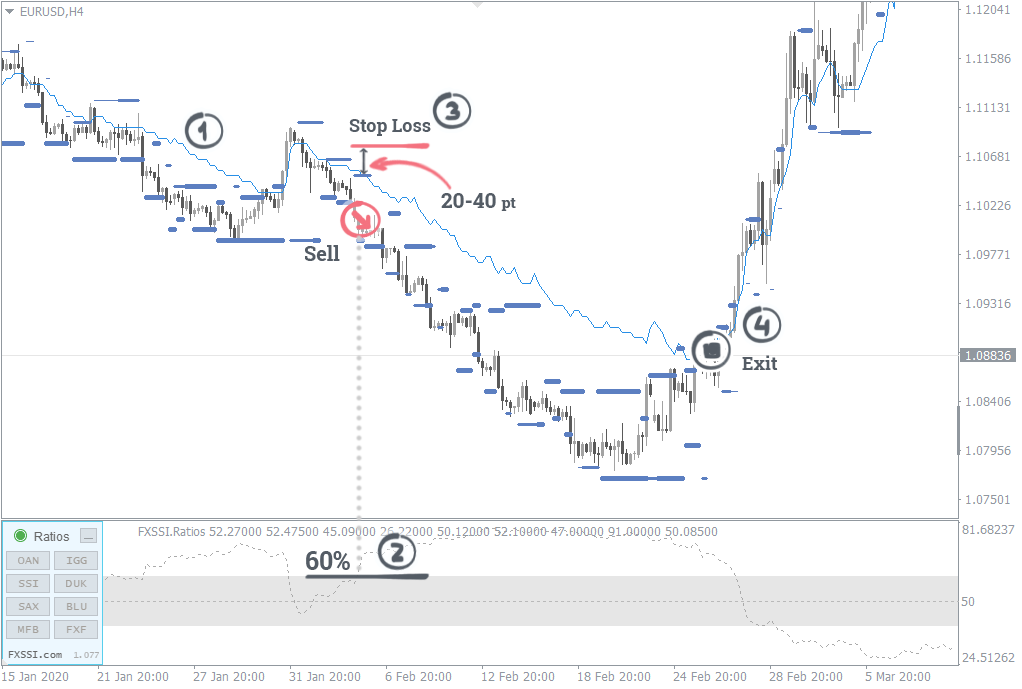

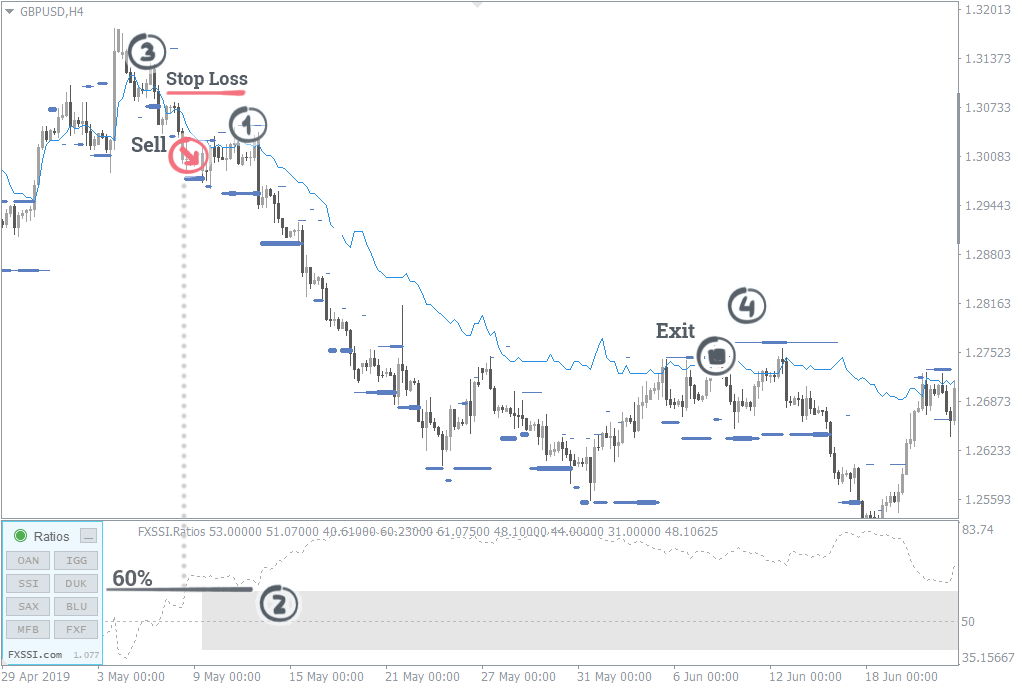

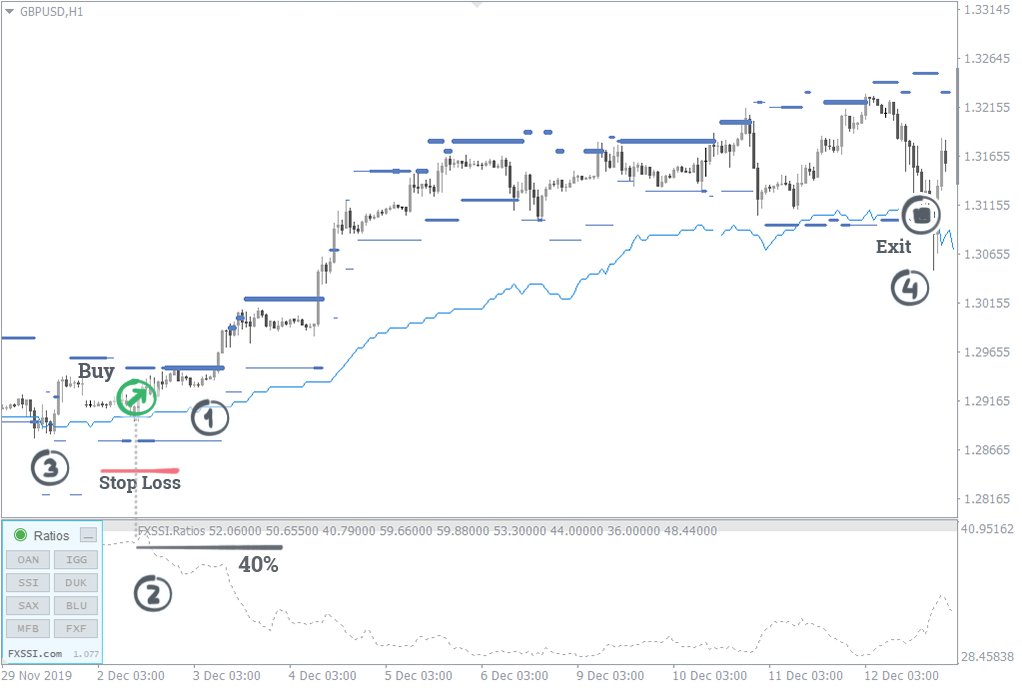

Ratios Indicator

The indicator shows: the historical change in the Current Ratio indicator. The Ratios indicator draws a chart of Buy trades, while the percentage of Sell trades is calculated using the formula: 100% – % of Buy trades.

Purpose: identifying trade entry and exit points according to the current indicator readings, as well as searching for price manipulations in the chart over the previous period.

Pay attention to: the Current Ratio indicator average value (AVG) calculated based on the weight coefficients of several brokers.

Buy:

- when less than 40% of traders are holding long positions;

- in case of a sharp increase in the percentage of sellers for all brokers.

Sell:

- when more than 60% of traders are holding long positions;

- in case of a sharp increase in the percentage of buyers for all brokers.

Trade exit:

- balance of ~50/50% has been reached;

- the ratio of positions has gone beyond 30% or 70%, which indicates that the financial instrument is significantly overbought or oversold.

The indicator doesn’t show particular levels for setting Take Profits and Stop Losses, but the following parameters are the most efficient:

Take Profit: 40-80 points, depending on the market situation.

Stop Loss: 40-80 points, depending on the market situation.

Indicator Features:

- Following a trend.

- Mid-term trading (a week).

- Timeframe – M30-H4.

Advantage: it allows you to carry out a historical analysis of retail traders’ positions relative to the price movement.

The success rate of signal (in percent): from 55 to 70%.

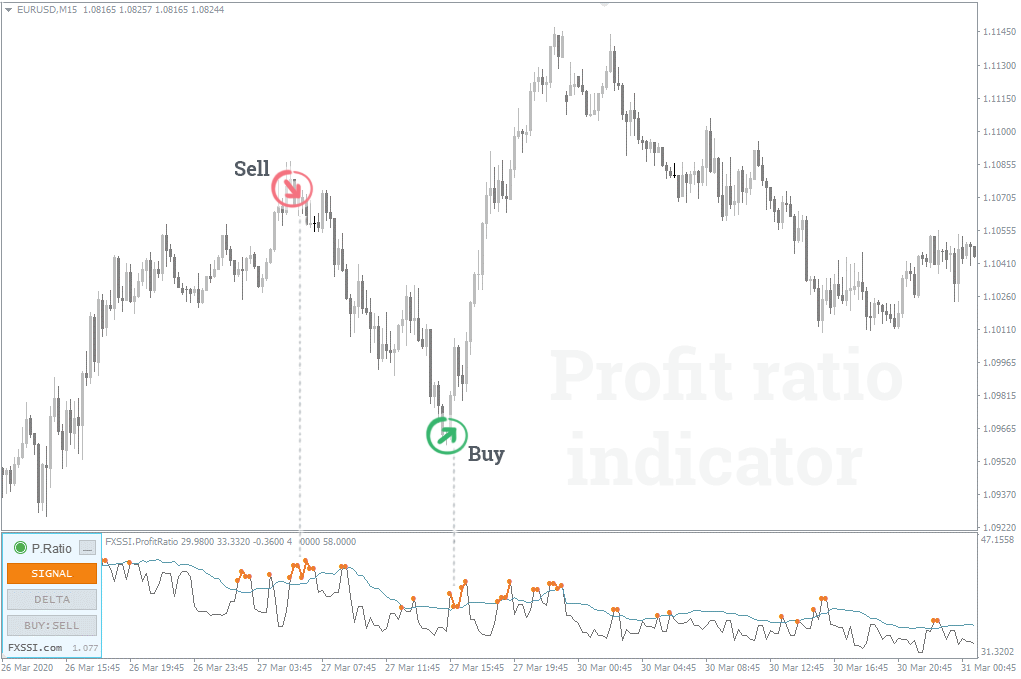

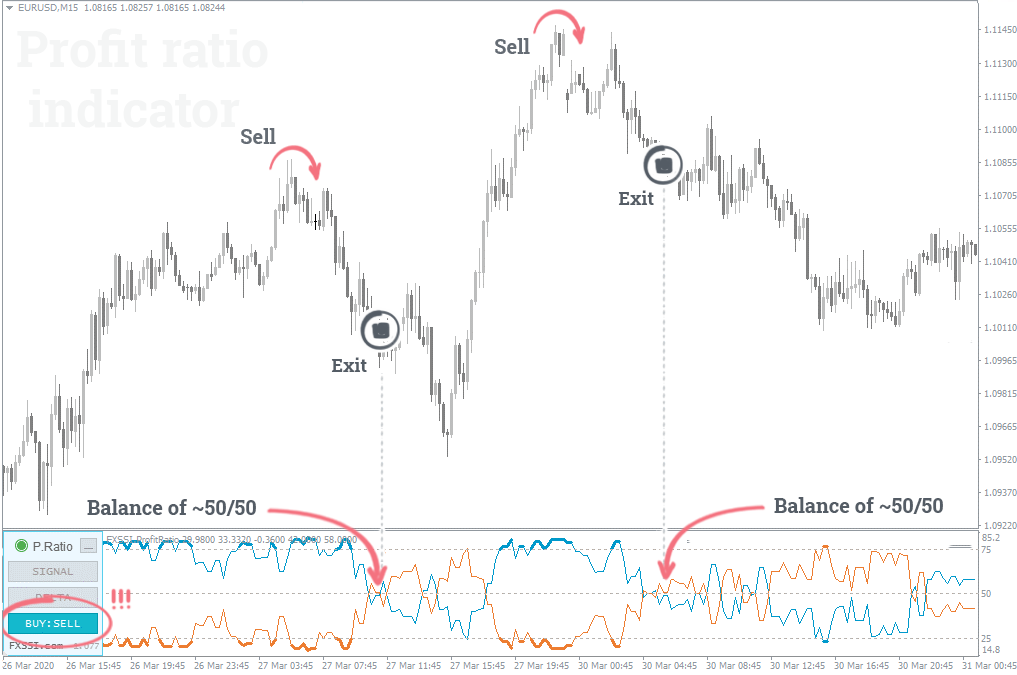

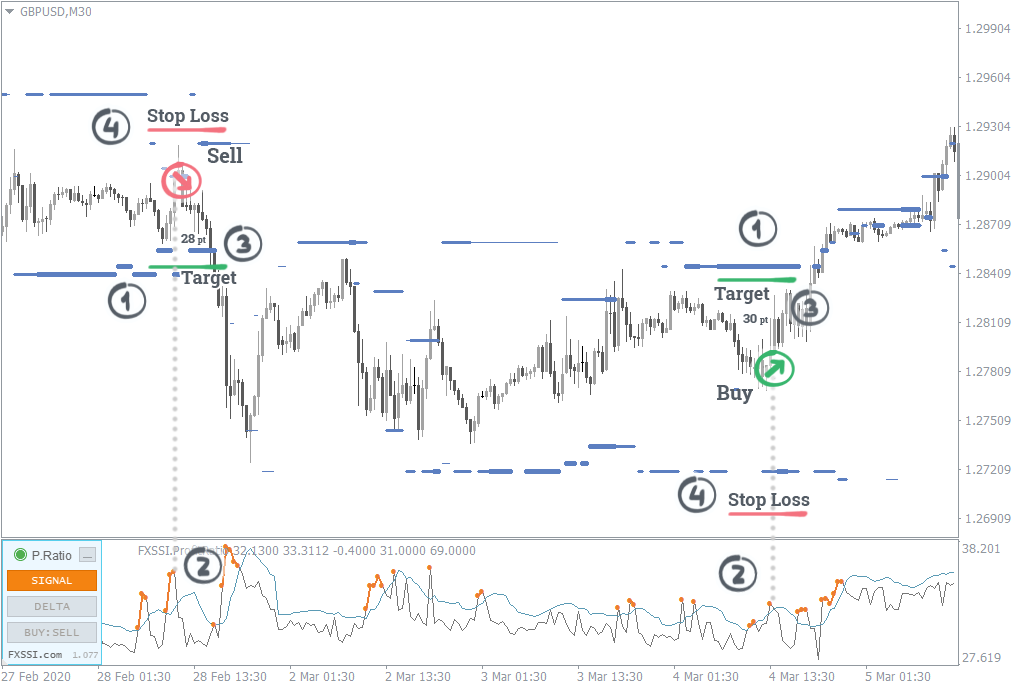

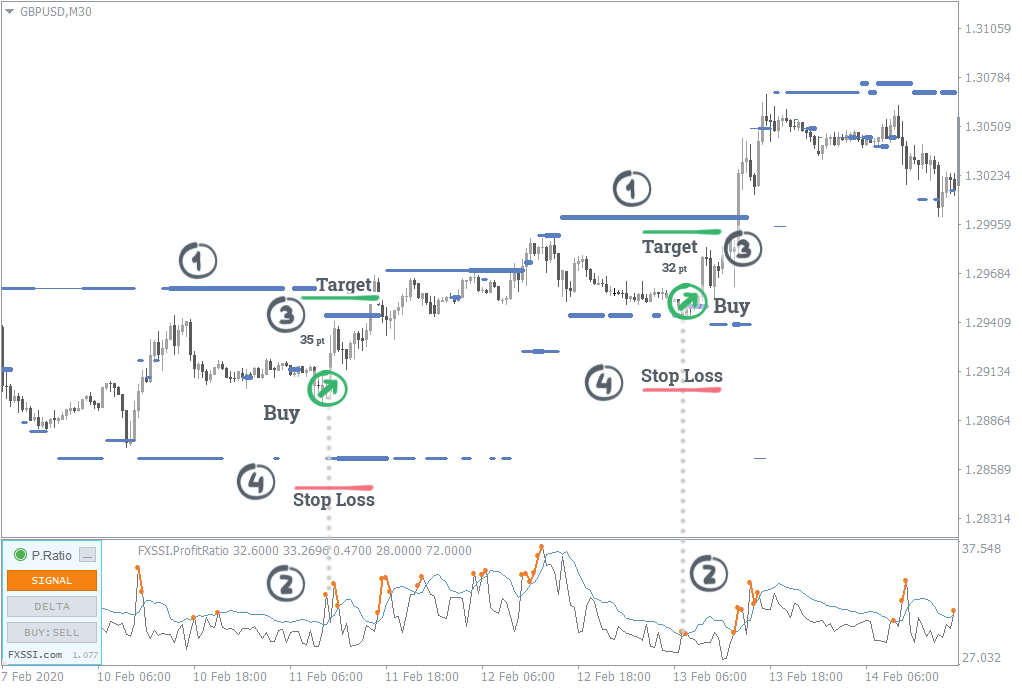

Profit Ratio Indicator

The indicator shows: the percentage of profitable traders of the total number. It also allows you to analyse both current and historical data.

Purpose: searching for price reversal points, as well as setting Limit orders at the potential reversal level.

Pay attention to: sharp spikes (increases) in the number of winning traders. When this happens, the gray line of the indicator will be colored orange, which is a signal of a possible price reversal.

Buy: in a downtrend, when the orange line of the indicator appears. The orange line signals a possible price reversal and a subsequent upward movement.

Sell: in an uptrend, when the orange line of the indicator appears. The orange line signals a possible price reversal and a subsequent downward movement.

Trade exit:

- if the opposite signal occurs;

- the balance (~50/50%) between winning buyers and sellers has been reached in BUY:SELL mode. It indicates that a trend movement has been exhausted.

The Profit Ratio signals are short-term, so the size of the Take Profit and Stop Loss shouldn’t exceed 60% of the daily range. You may set Take Profit higher since you open a trade at the very beginning of the price movement.

Take Profit: 20-60 points, depending on the market situation.

Stop Loss: 20-40 points, depending on the market situation.

Indicator Features:

- Trend reversal, trading in the flat market.

- Short-term trading (intraday).

- Timeframe – M5-M30.

Advantage: it allows you to see the Pareto principle in action, i.e., as soon as the number of winning traders exceeds 30%, the price immediately begins to react (reverse) and will not allow traders to close their trades in profit.

The success rate of signal (in percent): from 55 to 65%.

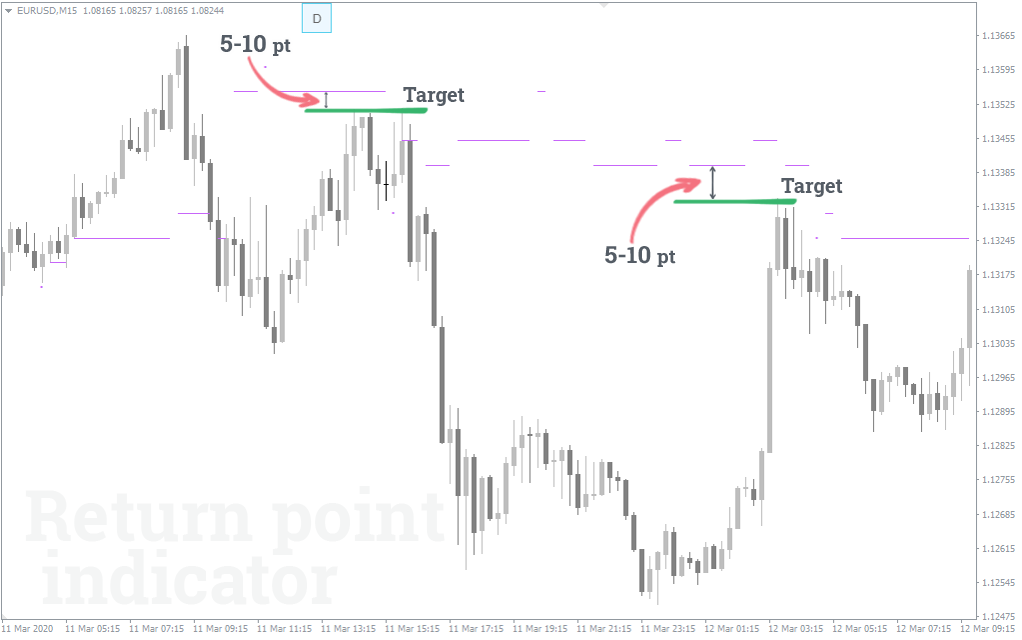

Derivatives – Return Point (RP) Indicator

The indicator shows: the price level at which the minimum number of winning traders will be reached (not to be confused with the balance on the buy/sell tab of the Profit Ratio indicator).

Purpose: Take Profit setting. Sometimes it is also used to determine the priority direction of a trade.

Pay attention to: the position of the purple line (RP) relative to the current price.

Buy/Sell: the indicator is not designed to search for entry points.

Trade exit: the price hitting the RP level can be the signal to exit a trade.

Take Profit: for Buy trades, it should be set at the RP level above the current price and for Sell trades – at the RP level below the current price. It is recommended to set Take Profit with a 5-10 points margin from the indicator level towards the entry-level.

Stop Loss: the indicator is not designed to search for the level where Stop Loss should be set.

Indicator Features:

- Trading in the flat market.

- Short-term trading (1-3 days).

- Timeframe – М5-М30.

- Its operation range is from 15 to 65 points. It is not recommended to use the indicator if the RP level is more than 65 points away from the current price.

Advantage: it allows you to analyse how the price tends to get into the equilibrium state, at which the minimum number of winning traders is reached.

The success rate of signal (in percent): from 55 to 60%.

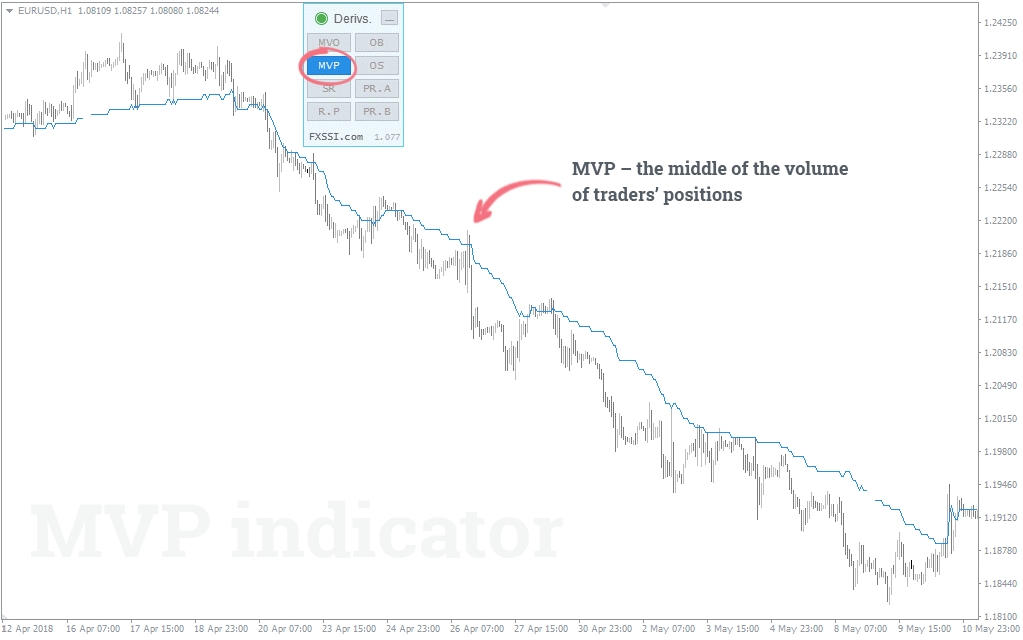

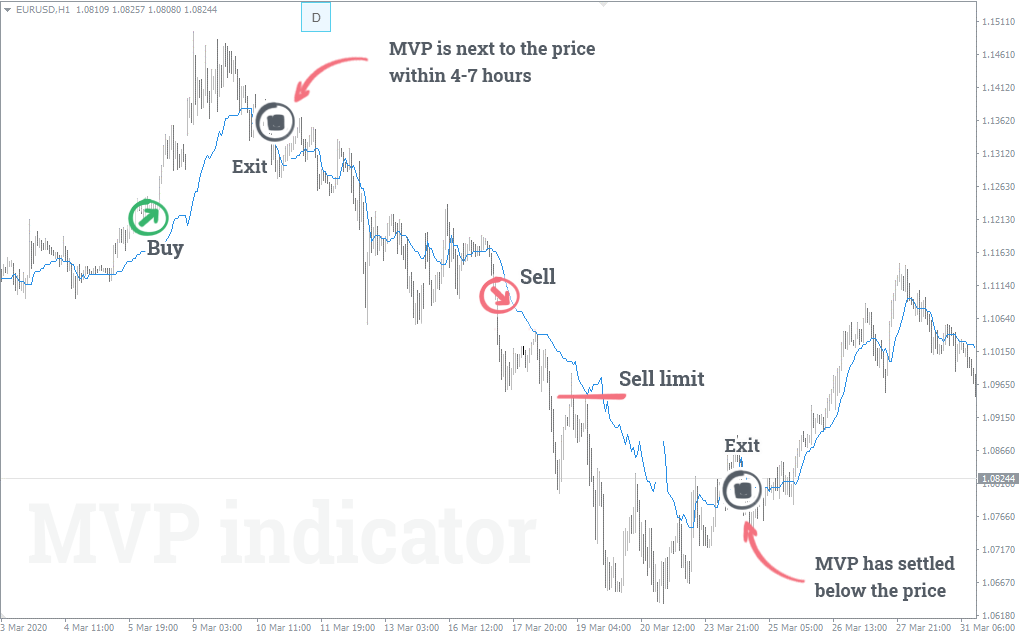

Derivatives – Middle Volume Positions Indicator (MVP)

The indicator shows: the price level at which the volume of trades opened above the indicator line is equal to that below the given line. In other words, the indicator spots the middle of the volume of open positions.

Purpose: identification of trend movement. It also helps to determine the support and resistance zones at the end of a retracement.

Pay attention to: the MVP line changes over time.

Buy: when the indicator line is below the current price. During an upward movement, you can also set a Buy Limit order at the MVP level or open a trade when the price touches the MVP line (only if there is a trend in the market).

Sell: when the indicator line is above the current price. During a downward movement, you can also set a Sell Limit order at the MVP level or open a trade when the price touches the MVP line (only if there is a trend in the market).

Trade exit: a change in the indicator direction can be the signal to close a trade. If a Buy trade has been opened, it is recommended to close it when the indicator line settles above the price or fluctuates within the range of the current price for 4-7 hours. The same is true for selling.

Take Profit/Stop Loss: the indicator doesn’t give recommendations regarding these levels.

Indicator Features:

- Following a trend.

- Mid-term trading (1-2 weeks).

- Timeframe – M30.

Advantage: it allows you to determine a trend movement with high probability. In addition, comparing the MVP with a moving average (MA), which is the most common trend indicator, you can observe similar readings. But the signals from the MVP come 12-15 hours earlier than from the MA indicator.

The success rate of signal (in percent): from 60 to 75%.

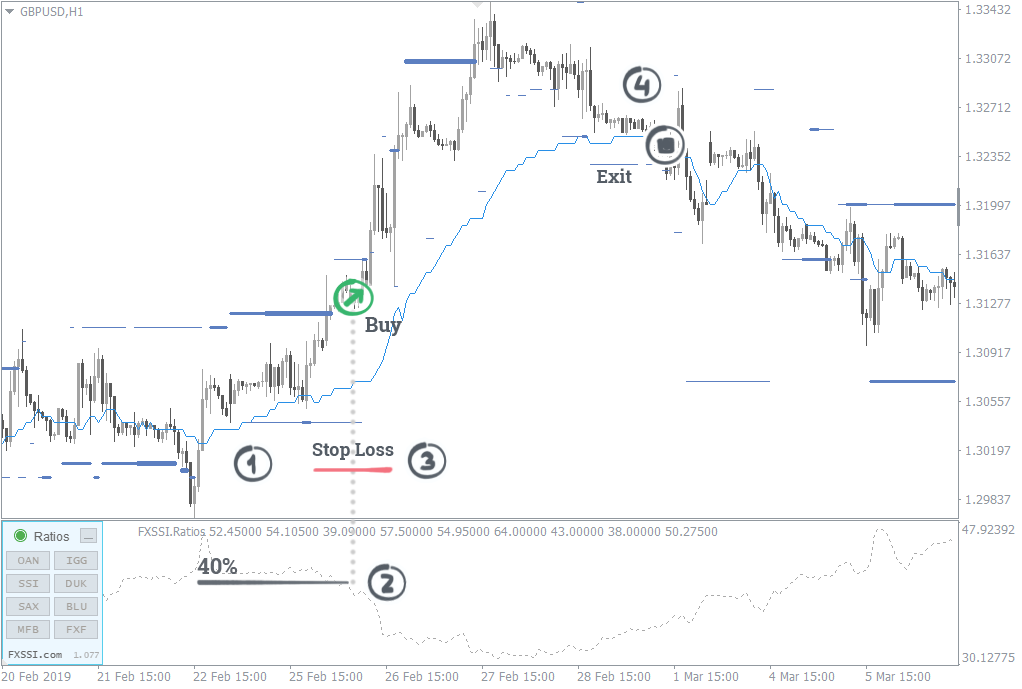

Stop Loss Clusters Indicator

The indicator shows: zones where Forex traders have set their Stop Losses, grouped into small, medium and large clusters.

Purpose: placing Take Profit, Stop Loss, and Limit orders, as well as searching for entry points when the price moves in the flat market.

Pay attention to: large (thick line) and medium (line of medium thickness) clusters of other traders' Stop Losses.

Buy: if the price falls and touches a Stop Loss cluster expecting a reversal. You can also place a Buy Limit order in the zone of these clusters. These recommendations are applicable outside of trend movements only.

Sell: if the price rises and touches a Stop Loss cluster expecting a reversal. You can also place a Sell Limit order in the zone of these clusters. These recommendations are applicable outside of trend movements only.

Trade exit: exclusively by Stop Loss or Take Profit.

Take Profit: it is recommended to set it at the level of large-sized (higher priority) and medium-sized Stop Loss clusters. In addition, Take Profit should be set with a 5-10 points margin from the SLC indicator level towards the entry-level.

Stop Loss: avoid setting your Stop Loss at the level where Stop Losses of other traders are positioned. To place it correctly and protect it from knocking out, it is recommended to hide it behind large- and medium-sized clusters. You should set it with a 20-40 points margin from the SLC indicator level further from the entry-level.

Indicator Features:

- Trading in the flat market and following a trend.

- Short-term trading (1-3 days).

- Timeframe – M5-M30.

- Its operation range for setting Take Profit is from 20 to 65 points. If the Stop Loss cluster is more than 65 points away from the indicator, the probability that the price is going to reach it will decrease.

Advantage: Stop Loss clusters of retail traders are a kind of magnet for the price since the zones of the best prices, at which the smart money (banks, funds, brokers, etc.) enters the market, are near them.

In case of a trend, you can see that the levels of Stop Loss clusters are constantly moving. It is because the market crowd doesn’t believe that the movement is true and constantly relocates its Stop orders or opens a trade with a small Stop Loss expecting the price to reverse. During a trend, you should focus only on the clusters located in the direction of the trend.

On the contrary, in the flat market, Stop Losses of the crowd are frequently knocked out, followed by a further price reversal.

The success rate of signal (in percent): from 60 to 75%.

Trading Activity Indicator

The indicator shows: increase/decrease in Long and Short positions at the studied time interval. You can also observe the points with massive entries/exits of retail traders.

Purpose: the analysis of the priority direction of price movement, as well as searching for price reversals.

Pay attention to: the delta showing the difference between opened Buy and Sell trades.

Buy: when the indicator shows the high volume of the red delta, an upward price reversal can be observed in this case.

Sell: when the indicator shows the high volume of the green delta, a downward price reversal can be observed in this case.

Trade exit: exit signals are identical to entry ones but in the opposite direction.

Take Profit/Stop Loss: the indicator doesn’t give recommendations regarding these levels.

Indicator Features:

- Trading in the flat market and following a trend.

- Short-term trading (intraday).

- Timeframe – M5-M30.

Advantage: it allows you to observe price levels that were of interest to most retail traders. Based on this analysis, you can accurately determine support and resistance levels.

The success rate of signal (in percent): from 50 to 60%.

Integrated Application of Indicators

Combining the signals of FXSSI indicators provides a specific synergistic effect in comparison with their single use. Next, we’ll show the practical examples of trading strategies using several of these tools at once.

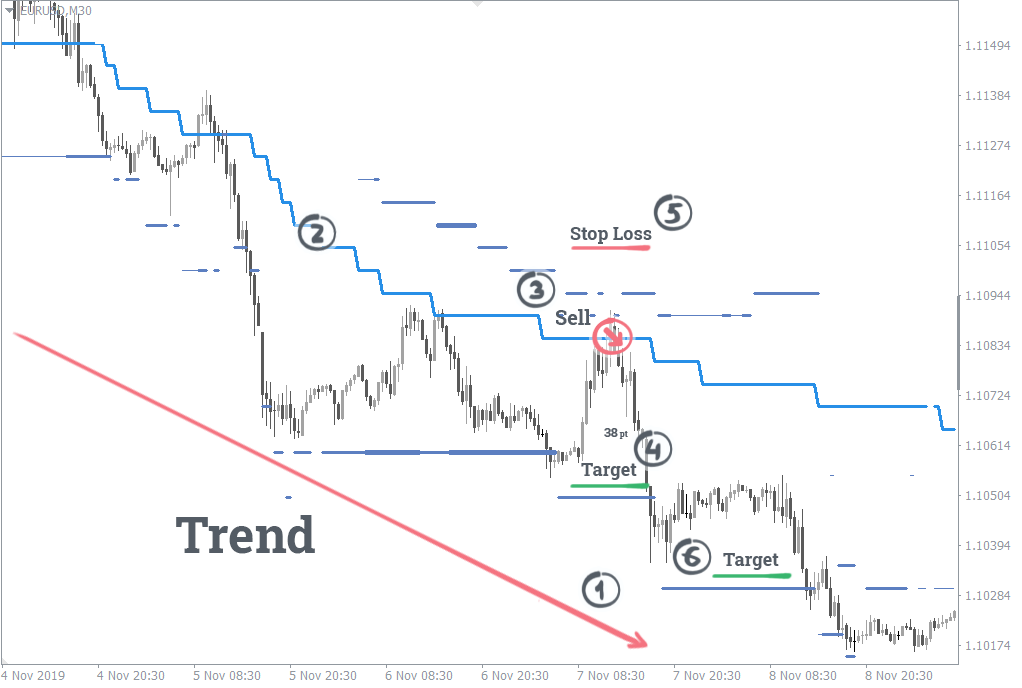

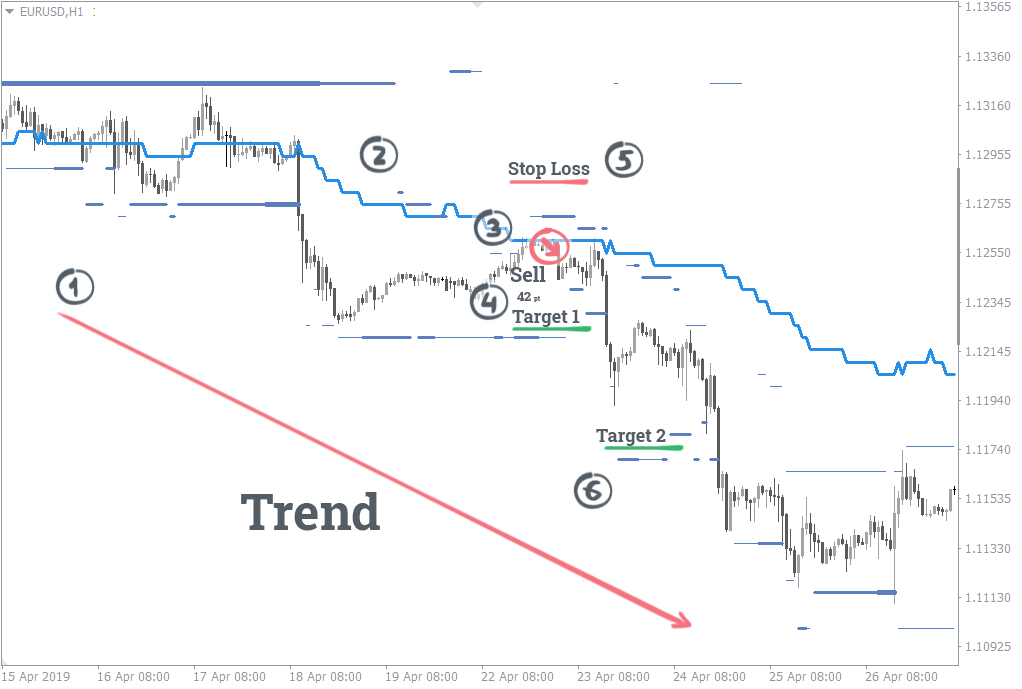

Example #1: MVP + Ratios + SLC

- The MVP analysis when the indicator line is above the current price.

- Enter a Sell trade when you receive a signal from the Ratios indicator showing 60%.

- Set the Stop Loss with a 20-40 points margin beyond the clusters of most traders further from the entry-level.

- Exit the trade if the price reaches the MVP indicator line and fluctuates in this zone within 4-7 hours.

Note: it is similar for Buy trades.

Case #1

Case #2

Case #3

Case #4

Case #5

Example #2: Profit Ratio + Trading Activity + SLC

- Enter a trade if there is a Profit Ratio signal.

- We see a spike in the delta of the Trading Activity indicator.

- If the RP indicator operation range is within 65 points, set Take Profit with a 5-15 points margin from the indicator level towards the entry-level.

- Set the Stop Loss with a 20-40 points margin beyond the clusters of most traders further from the entry-level.

Case #1

Case #2

Example #3: Profit Ratio + SLC

- Search for a large Stop Loss cluster.

- Enter a trade when you receive a signal from the Profit Ratio indicator.

- If the SLC indicator operation range is within 65 points, set Take Profit 5-15 points away from the SLC indicator level towards the entry level.

- Set the Stop Loss with a 20-40 points margin beyond the clusters of most traders further from the entry-level.

Case #1

Case #2

Example #4: MVP + SLC

- Determine the current market trend.

- Monitor the position of the MVP level.

- If the MVP is below the price, open a trade when the price crosses the MVP level or place a Limit order in a zone where MVP is likely positioned.

- Analyse the SLC indicator operation range. Set the Take Profit with a 5-15 points margin from the nearest Stop Losses clusters level towards the entry-level.

- Set the Stop Loss with a 20-40 points margin beyond the clusters of most traders further from the entry-level.

- If the zone of Stop Loss clusters is rebuilt from above, you can try to move your Stop Loss to breakeven and also relocate the Take Profit to the next level of clusters.

Note: it is similar for Buy trades.

Case #1

Case #2

Case #3

Case #4

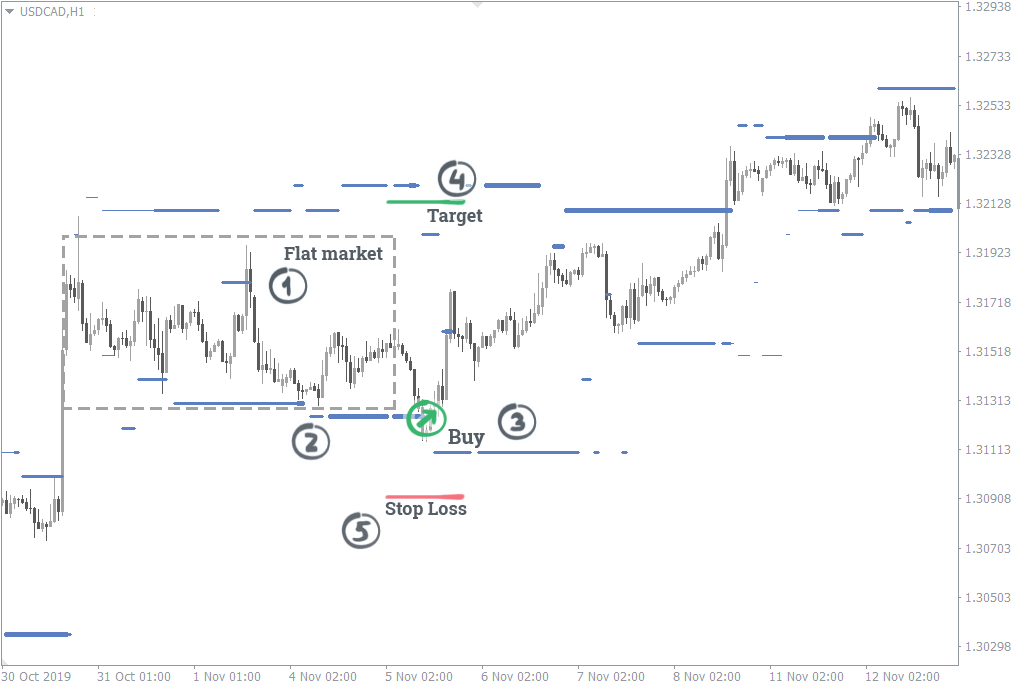

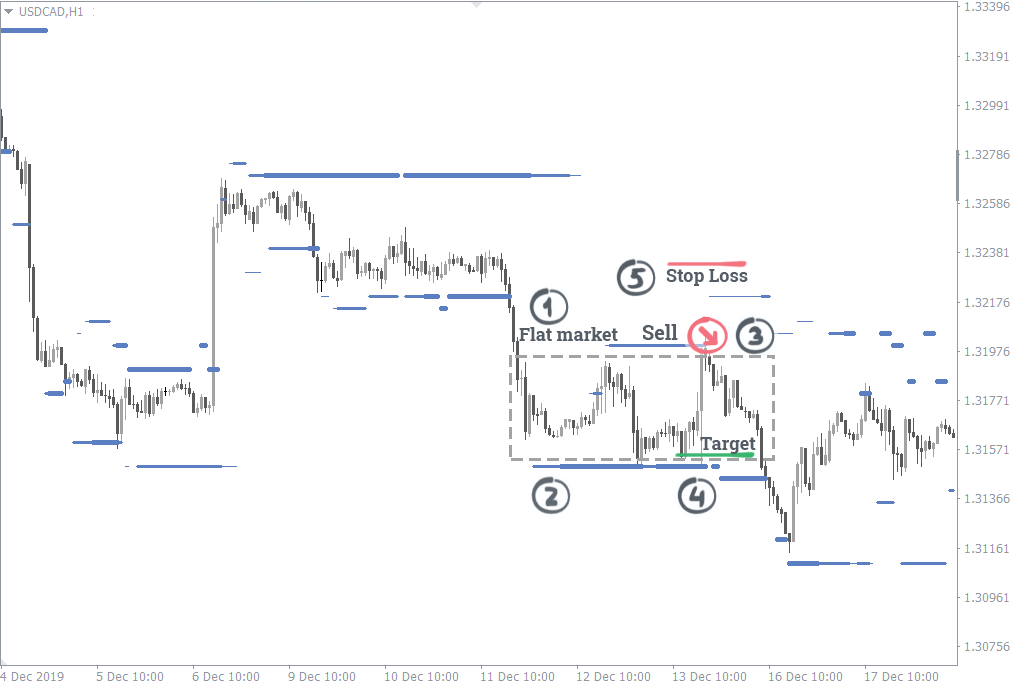

Example #5

- We see a flat market movement.

- A large Stop Loss cluster appears.

- Place the Limit order expecting the price to reverse from the given Stop Loss cluster or enter a reversal trade when these Stop Losses are knocked out.

- Set the Take Profit with a 5-15 points margin from the nearest Stop Loss cluster level towards the entry-level.

- Set the Stop Loss with a 20-40 points margin beyond the clusters of most traders further from the entry-level.

Case #1

Case #2

Case #3

Case #4

Case #5

These strategies are an example of how you can combine signals of several indicators. Real-world experience shows that the combination of these two types is the most efficient:

- indicators specifying entry points (Ratios, Profit Ratio, StopLoss Clusters),

- indicators specifying the placement of the Take Profit and Stop Loss orders (Return Point, StopLoss Clusters).

In addition, the MVP and Trading Activity indicators will inform you about the general price movement vector and will allow you to increase your chances of making a winning trade.

By combining indicators and using the contrarian strategy, you can easily choose your unique and most effective combination based on your trading experience.

Conclusion

In this guide, we did our best to present as much information as necessary to help you get familiar with our indicators. If you follow these recommendations, your trading strategy will most likely change, and its performance will improve. By combining the signals, you will definitely get the confirmation of their efficiency in real-world situations.

We should also point out that the FXSSI package includes the Order Book indicator, which provides data on Pending Orders and Open Positions. The Order Book allows you to better understand the crowd behaviour and analyse the market situation in more detail. Read the Order Book indicator trading guide here.

Risk Warning

All materials in this manual are for informational purposes only and must not be taken as a guidance for action. The data presented in this article are only the assumptions based on our experience. Trading leveraged financial instruments in the financial markets involves a high level of risk and might not be suitable for all investors. You are personally and solely responsible for making trading decisions and for the results obtained in the course of trading.

Contacts

Guide Version 1.01 (04.05.2020)